fulton county illinois property tax due dates 2021

931 Downloads 191 KB File Size June 4 2021 Published Download. The Application will need to be completed and notarized.

Fulton County Il Land Auction Sullivan Auctioneers

Some colleges supply the Certificate of Residence application.

. Overview Real estate taxes are generally due on February 5 for the first half billing and July 20 for the second half billing. If not our office provides a generic form which is also located on our website. Real Estate tax 1st installment due June 17.

FDTG - TABLE GROVE FIRE DIST. 682021 2nd Installment Due. Student must be a resident of Fulton County for six 6 months prior to the semester start date and a resident of New York State for one 1 year.

Payments and correspondence may always be mailed directly to the DuPage County Treasurers Office at 421 N. FRM TIF - FARMINGTON TIF. There are many offices that hold different pieces of information about your property tax and this page is intended to get you to the answer with as few clicks as possible.

The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. Real Estate Tax Due Dates 2021-06-04T090209-0500. Contact us for further listings or verification.

A penalty is effective after due date pursuant to State StatuesInterest is added at a rate of 15 per month. Target Corp Property Tax Dept. Lake County collects the highest property tax in Illinois levying an average of 628500 219 of median home value yearly in property taxes while Hardin County has the lowest property tax in the state collecting an average tax of 44700 071 of.

County Farm Road Wheaton IL 60187. INLW - LEWISTOWN INCREMENT. Real estate taxes are mailed out semi-annually and are always one year in arrears.

INCU - CUBA INCREMENT. 982021 Last day to pay to avoid Tax Sale. The deadline to pay property taxes is approaching.

Real Estate tax bills mailed May 14. INC2 - CANTON 2-Rt. Payments can be made through major credit cards eBilling eChecks Apple Pay and Google Pay.

Box 4203 Carol Stream IL 60197-4203. Property tax returns must be filed with the county tax office between January 1 and April 1 of each year. 2022 Property Tax Calendar.

INC3 - CANTON-SOUTH INCREMENT 3. County Code of Ordinances. Fulton County collects on average 178 of a propertys assessed fair market value as property tax.

FDTH - TIMBER HOLLIS FIRE DIST. If the due date falls on a holiday or a weekend the due date will be extended to the next working day. The initial Form PTAX-327 Application for Natural Disaster Homestead Exemption must be filed with the Chief County Assessment Office no later than July 1 of the first taxable year after the residential structure is rebuilt or the filing date set by your county.

FULTON COUNTY HOMESTEAD EXEMPTION WWWFULTONASSESSORORG GUIDE FULTON COUNTY 2021 HOMESTEAD EXEMPTION GUIDE HOMESTEAD EXEMPTION DEADLINE - APRIL 1 2021 APPLY ONLINE AT WWWFULTONASSESSORORG CALL US AT 404-612-6440 X 4 IF YOU OWN AND LIVE IN A HOME IN FULTON COUNTY HOMESTEAD EXEMPTIONS MAY HELP. By now all Fulton County property owners should have received tax statements by mail. Please contact the office if you dont receive a bill.

DuPage County Collector PO. Mobile Home tax due May 14. Macon County Property Tax Information.

Credit card payments accepted for real estate tax June 16. Illinois is ranked 893rd of the 3143 counties in the United States in order of the median amount of property taxes collected. The exact property tax levied depends on the county in Illinois the property is located in.

In Illinois Fulton County is ranked 42nd of 102 counties in Treasurer Tax Collector Offices per capita and. The Official Government Website of Macon County Illinois. The 1st half 2021 Real Estate taxes are due by February 7 th 2022.

In Cook County the first installment is due by March 1. The median property tax in Fulton County Illinois is 1406 per year for a home worth the median value of 79000. Download the Illinois.

Taxes paid within 10 days of the due date are subject to 5 penalty. 1st Installment Due. 2020 - Property Tax Due Dates.

This page is your source for all of your property tax questions. Each advertisement shows the owners name a description of the property to be sold and the amount of the tax due OCGA. Please type the text you see in the image into the text box and submit.

The Form PTAX-327 must be filed each year to continue to receive the exemption. You should check with your county tax office for verification. Taxes paid after 10 days are subject to a 10 penalty.

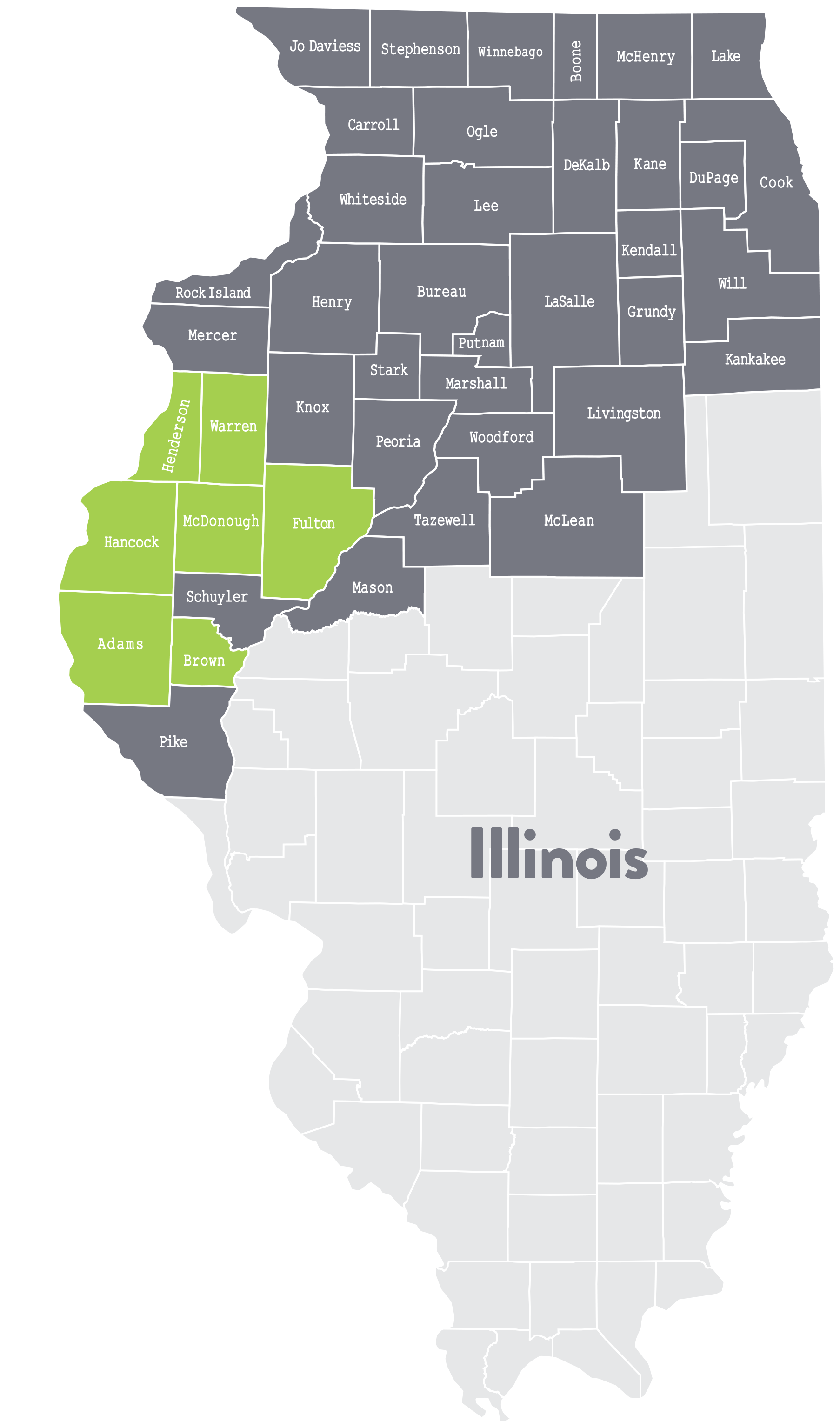

However it is not guaranteed and some dates andor jurisdictions are not listed. There are 2 Treasurer Tax Collector Offices in Fulton County Illinois serving a population of 35733 people in an area of 866 square milesThere is 1 Treasurer Tax Collector Office per 17866 people and 1 Treasurer Tax Collector Office per 432 square miles. Mobile Home tax bills mailed June 1.

Important Property Tax Dates in 2021. Property Tax Info 2021-01-16T141128-0600. On August 25 2021 the.

Elsewhere a county board may set a due date as late as June 1 The second installment is prepared and mailed by June 30 and is for the balance of taxes due. This information is deemed to be a reliable calendar of specific property tax event dates that are updated quarterly and throughout the year as changes are known. This installment is mailed by January 31.

Clair County Board of Review was notified of the appeals on May 27 2021 and was granted a 90-day extension to submit evidence with a due date of August 25 2021. INIH - CANTON 1-DOWNTOWN 5TH AVENUE INCREMENT. The 2nd half 2021 Real Estate taxes will be due on July 20 th 2022.

Under this system the first installment of taxes is 55 percent of last years tax bill. The Fulton County Treasurers Office located in Lewistown Illinois is responsible for financial transactions including issuing Fulton County tax bills collecting personal and real property tax payments. The Fulton County Treasurer and Tax Collectors Office is part of the Fulton County Finance Department that encompasses all financial.

FDVR - VERMONT FIRE DIST. In some counties property tax returns are filed with the county tax commissioner and in other counties returns are filed with the county board of tax assessors. The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set by the Board of Commissioners and.

Beginning May 1 2021 through September 30 2021 payments may also be mailed to.

Fulton Illinois Il 61252 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Fulton County Circuit Clerk S Office Home Facebook

Fulton County Il Land For Sale 42 Listings Landwatch

Land Values Accelerate Across West Central Illinois

Manhunt Underway As Inmates Escape Fulton County Jail Wjbc Am 1230

Fulton County Small Business Covid 19 Relief Grant Fcsbg Now Available City Of Canton

Fulton Illinois Il 61252 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Ignoring Reality Inside The Property Tax Appeals Game Crain S Chicago Business

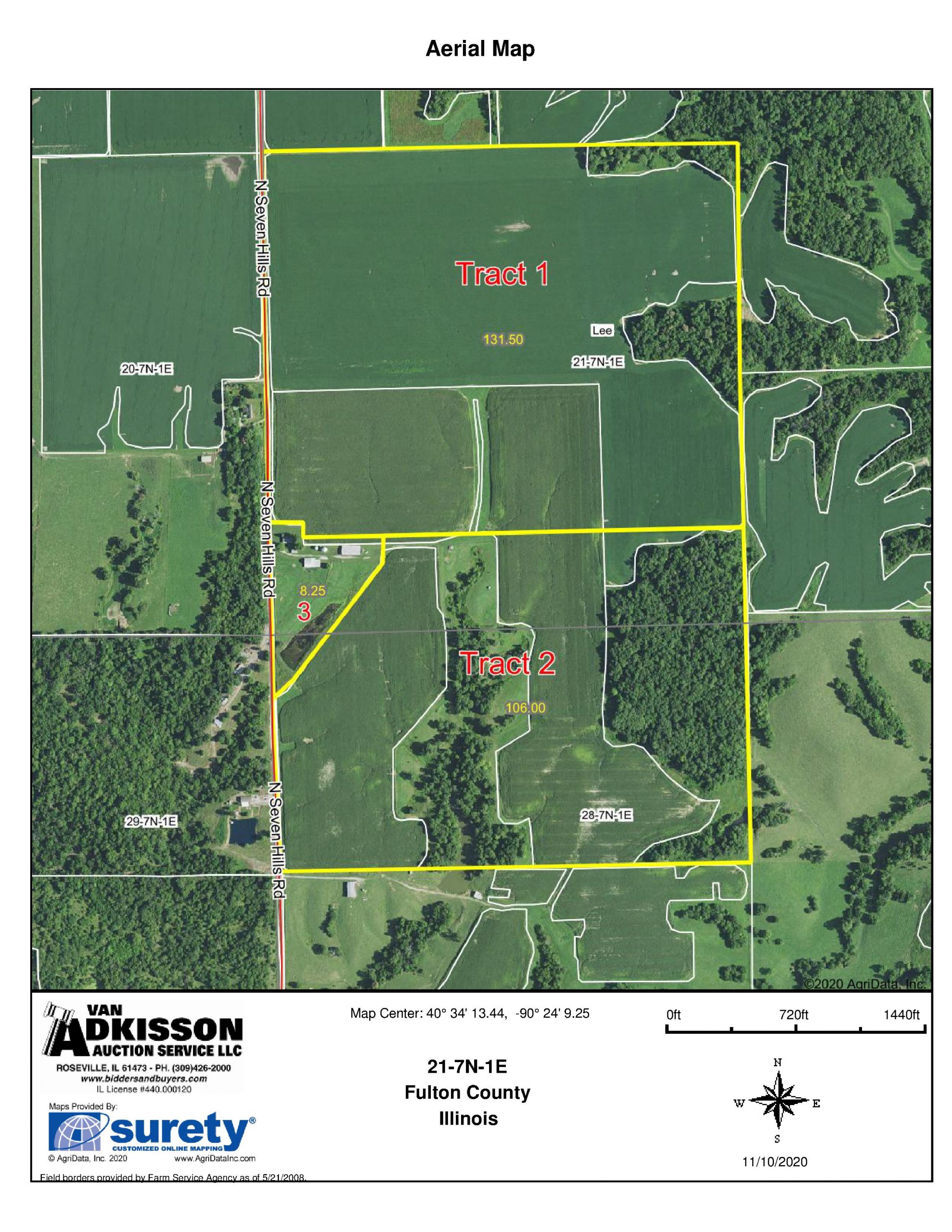

Land Auction 246 58 Surveyed Acres 3 Tracts Productive Farmland Country Home Timber Grassland Fulton County Il Van Adkisson

Fulton County Il Land Auction Westerfield Sullivan Auctioneers

Fulton Giving Property Owners Until Aug 5 To Appeal Tax Assessments Neighbornewsonline Com Suburban Atlanta S Local Mdjonline Com

Fulton County Farm Bureau Home Facebook

Fulton County Il Land Auction Westerfield Sullivan Auctioneers

Terms Fulton County Treasurer Il Online Payments

Fulton County Circuit Clerk S Office Home Facebook

Fulton County Il Land Auction Westerfield Sullivan Auctioneers